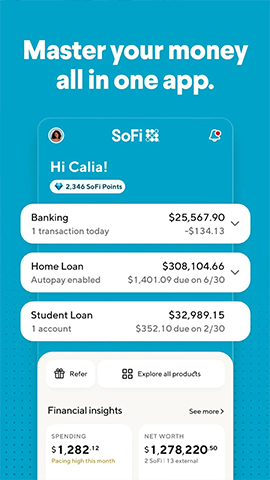

SoFi - Banking&Investing is a mobile application that provides comprehensive financial services. Its application description can be summarized from the following aspects:

1、 Service Overview

SoFi (Social Finance, Inc.), founded in 2011 and headquartered in San Francisco, California, is an Internet financial services company. SoFi provides users with four major categories of financial services, including lending, investment, insurance, and bank savings accounts, through its mobile applications and online platform. SoFi is committed to becoming a one-stop shop for financial products that consumers need, meeting the diverse financial needs of different users.

2、 Main functions

Loan services:

Student loans: SoFi started with student loans and focuses on providing low interest loans for high credit students. With market changes, SoFi has also launched a student loan refinancing service to help borrowers re borrow at lower interest rates and alleviate repayment pressure.

Mortgage loan for houses: SoFi also provides mortgage loan services for houses, with down payments as low as 10%, far below the requirements of traditional banks, and the application process is greatly simplified. In addition, SoFi has also launched a mortgage refinancing business, utilizing the increase in home equity for refinancing.

Personal loans: SoFi's personal loan business provides borrowers with an alternative to high interest credit cards, which can be used to reduce existing credit card debt, pay for renovation, medical, vacation, and other expenses.

Investment Services:

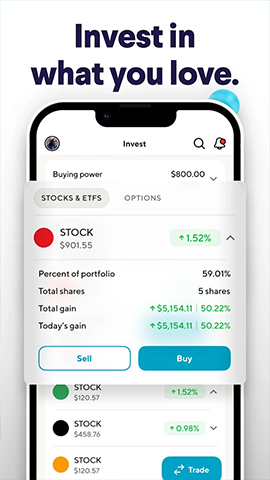

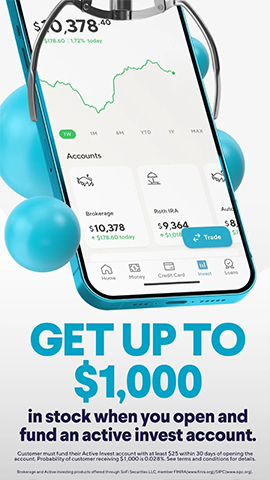

SoFi Invest: SoFi Invest is an incomplete margin account that supports trading stocks, ETFs, and virtual currencies (does not support trading options). Users can create low-cost, tax efficient investment portfolios and enjoy automatic rebalancing and portfolio optimization services. In addition, SoFi Invest also provides Stock Bits functionality, allowing users to purchase stocks smaller than 1 share.

Smart investment advice: SoFi Invest also provides smart investment advice to help users make wiser investment decisions. Users can also contact financial advisors to answer investment questions or provide guidance on improving their overall financial situation.

Bank savings account:

SoFi Money: SoFi Money is an online checking account with no transaction fees, no monthly fees, no minimum deposit amount, and interest on deposits (specific interest rates may vary depending on the market). In addition, SoFi Money also offers a global ATM cash withdrawal service with almost no transaction fees (within daily limits), and reimburses ATM fees charged by other institutions.

Insurance services:

SoFi has partnered with insurance companies to launch life insurance products and is exploring insurance products in categories such as property and accidental injury. By understanding the overall financial situation of customers, SoFi can propose optimal solutions and provide a better customer experience.

3、 User reviews

The application of SoFi has received high praise from users. Users generally believe that its interface is friendly, the service is convenient, and the cost is reasonable. Especially in the investment field, SoFi Invest provides users with rich investment choices and personalized investment advice, helping users achieve wealth appreciation.

4、 Summary

SoFi - Banking&Investing is a comprehensive and high-quality financial application. SoFi is committed to meeting the diverse financial needs of its users by providing comprehensive financial services such as lending, investment, insurance, and bank savings accounts. Whether students, professionals, or investors, they can find suitable financial products and services on SoFi.

SoFi - Banking&Investing is a mobile application that provides comprehensive financial services. Its application description can be summarized from the following aspects:

1、 Service Overview

SoFi (Social Finance, Inc.), founded in 2011 and headquartered in San Francisco, California, is an Internet financial services company. SoFi provides users with four major categories of financial services, including lending, investment, insurance, and bank savings accounts, through its mobile applications and online platform. SoFi is committed to becoming a one-stop shop for financial products that consumers need, meeting the diverse financial needs of different users.

2、 Main functions

Loan services:

Student loans: SoFi started with student loans and focuses on providing low interest loans for high credit students. With market changes, SoFi has also launched a student loan refinancing service to help borrowers re borrow at lower interest rates and alleviate repayment pressure.

Mortgage loan for houses: SoFi also provides mortgage loan services for houses, with down payments as low as 10%, far below the requirements of traditional banks, and the application process is greatly simplified. In addition, SoFi has also launched a mortgage refinancing business, utilizing the increase in home equity for refinancing.

Personal loans: SoFi's personal loan business provides borrowers with an alternative to high interest credit cards, which can be used to reduce existing credit card debt, pay for renovation, medical, vacation, and other expenses.

Investment Services:

SoFi Invest: SoFi Invest is an incomplete margin account that supports trading stocks, ETFs, and virtual currencies (does not support trading options). Users can create low-cost, tax efficient investment portfolios and enjoy automatic rebalancing and portfolio optimization services. In addition, SoFi Invest also provides Stock Bits functionality, allowing users to purchase stocks smaller than 1 share.

Smart investment advice: SoFi Invest also provides smart investment advice to help users make wiser investment decisions. Users can also contact financial advisors to answer investment questions or provide guidance on improving their overall financial situation.

Bank savings account:

SoFi Money: SoFi Money is an online checking account with no transaction fees, no monthly fees, no minimum deposit amount, and interest on deposits (specific interest rates may vary depending on the market). In addition, SoFi Money also offers a global ATM cash withdrawal service with almost no transaction fees (within daily limits), and reimburses ATM fees charged by other institutions.

Insurance services:

SoFi has partnered with insurance companies to launch life insurance products and is exploring insurance products in categories such as property and accidental injury. By understanding the overall financial situation of customers, SoFi can propose optimal solutions and provide a better customer experience.

3、 User reviews

The application of SoFi has received high praise from users. Users generally believe that its interface is friendly, the service is convenient, and the cost is reasonable. Especially in the investment field, SoFi Invest provides users with rich investment choices and personalized investment advice, helping users achieve wealth appreciation.

4、 Summary

SoFi - Banking&Investing is a comprehensive and high-quality financial application. SoFi is committed to meeting the diverse financial needs of its users by providing comprehensive financial services such as lending, investment, insurance, and bank savings accounts. Whether students, professionals, or investors, they can find suitable financial products and services on SoFi.