Now employees paid through Gusto can put their money to work with Gusto Wallet.

Gusto Wallet helps you earn, save and spend right within your Gusto account. It’s the easiest way to take control of your financial future.

- Get paid up to two days early with a Gusto spending account [1]

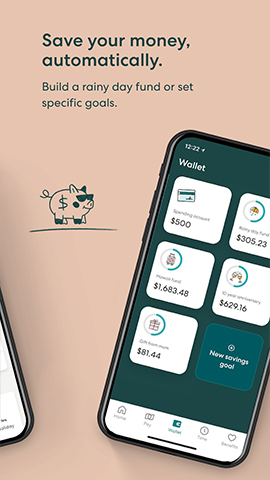

- Save towards custom goals with auto savings

- No minimum balances, account fees, or overdraft fees [2]

- Get a Gusto debit card for simple spending

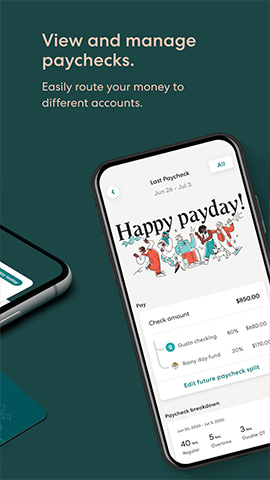

- Route your cash with the paycheck splitter

- Easily view paychecks and tax documents

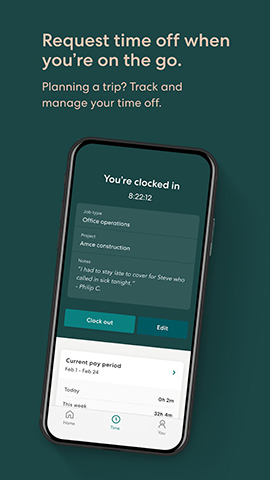

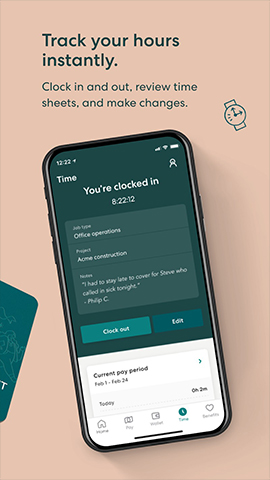

- Clock in and out, review time sheets, and more instantly

We want to make sure you have all the details you need. Here’s some legal info about numbers, who we’re working with, and more:

[1] With a Gusto spending account, your payment may be processed up to 2 days early. Timing depends on when your employer sends payment funds.

[2] Some fees, such as out-of-network ATM and foreign transactions fees, may apply. Check the terms and conditions carefully.

Gusto is a payroll services company, not a bank. Gusto savings goals, spending account, and debit card are issued by nbkc bank, Member FDIC.

FDIC insurance is provided by nbkc bank, Member FDIC. Any balances you hold with nbkc bank, including but not limited to those balances held in Gusto accounts are added together and are insured up to $250,000 per depositor through nbkc bank, Member FDIC. If you have funds jointly owned, these funds would be separately insured for up to $250,000 for each joint account owner. nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your Gusto accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank-list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation.

Now employees paid through Gusto can put their money to work with Gusto Wallet.

Gusto Wallet helps you earn, save and spend right within your Gusto account. It’s the easiest way to take control of your financial future.

- Get paid up to two days early with a Gusto spending account [1]

- Save towards custom goals with auto savings

- No minimum balances, account fees, or overdraft fees [2]

- Get a Gusto debit card for simple spending

- Route your cash with the paycheck splitter

- Easily view paychecks and tax documents

- Clock in and out, review time sheets, and more instantly

We want to make sure you have all the details you need. Here’s some legal info about numbers, who we’re working with, and more:

[1] With a Gusto spending account, your payment may be processed up to 2 days early. Timing depends on when your employer sends payment funds.

[2] Some fees, such as out-of-network ATM and foreign transactions fees, may apply. Check the terms and conditions carefully.

Gusto is a payroll services company, not a bank. Gusto savings goals, spending account, and debit card are issued by nbkc bank, Member FDIC.

FDIC insurance is provided by nbkc bank, Member FDIC. Any balances you hold with nbkc bank, including but not limited to those balances held in Gusto accounts are added together and are insured up to $250,000 per depositor through nbkc bank, Member FDIC. If you have funds jointly owned, these funds would be separately insured for up to $250,000 for each joint account owner. nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your Gusto accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank-list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation.